Retirement

Where will your retirement money come from? If you’re like most people, qualified-retirement plans, Social Security, personal savings and investments are expected to play a role. Once you have estimated the amount of money you may need for retirement, a sound approach involves taking a close look at your potential retirement-income sources.

Top 5 Things to Tell Your Financial Pro

Here are the top 5 things your team may want to hear.

Have A Question About This Topic?

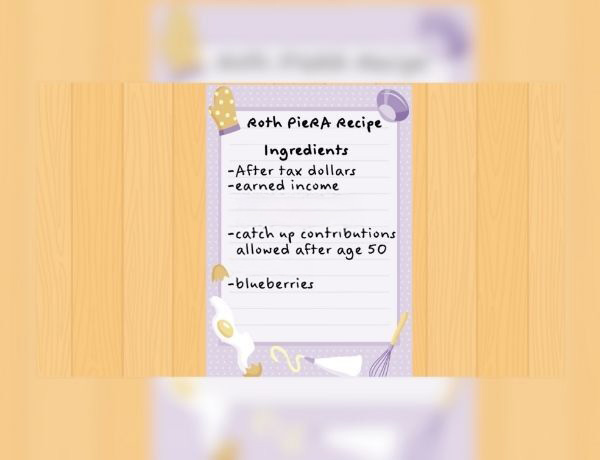

How to Bake a Pie-R-A

Roth IRAs are tax-advantaged differently from traditional IRAs. Do you know how?

Tax Efficiency in Retirement

What role would taxes play in your investment decisions?

Should You Ever Retire?

A growing number of Americans are pushing back the age at which they plan to retire. Or deciding not to retire at all.

Tips for Improving Your Financial Health into Retirement

Here are ten key steps to help improve your financial health and make the most of your retirement years.

Understanding Qualified Charitable Distributions

Use this handy, informative article to help your clients understand Qualified Charitable Distributions (QCDs).

A Bucket Plan to Go with Your Bucket List

Longer, healthier living can put greater stress on retirement assets; the bucket approach may be one answer.

Understanding Social Security: 5 Common Myths Explained

Have questions about Social Security? Explore five common myths to better understand your benefits and options.

Retirement Realities

Many pre-retirees can become focused on the “ideal” retirement, but turning that dream into a reality can be tricky.

Buying a Vacation Home? 5 Questions to Consider First

You may be considering purchasing a vacation property, this can be an exciting milestone, but there are a few things to consider first.

View all articles

Roth 401(k) vs. Traditional 401(k)

This calculator compares employee contributions to a Roth 401(k) and a traditional 401(k).

Estimate Your RMD

Help determine the required minimum distribution from an IRA or other qualified retirement plan.

My Retirement Savings

Estimate how long your retirement savings may last using various monthly cash flow rates.

Self-Employed Retirement Plans

Estimate the maximum contribution amount for a Self-Employed 401(k), SIMPLE IRA, or SEP.

Inflation & Retirement

Estimate how much income may be needed at retirement to maintain your standard of living.

A Look at Systematic Withdrawals

This calculator may help you estimate how long funds may last given regular withdrawals.

View all calculators

Should You Ever Retire?

A growing number of Americans are pushing back the age at which they plan to retire. Or deciding not to retire at all.

18 Years Worth of Days

The average retirement lasts for 18 years. What will you do with your days?

Retirement Plan Detectives

Watch this fun video for tips on how to search for missing money.

How to Bake a Pie-R-A

Roth IRAs are tax-advantaged differently from traditional IRAs. Do you know how?

Retirement and Quality of Life

Asking the right questions about how you can save money for retirement without sacrificing your quality of life.

Leaving Your Lasting Legacy

Want to do more with your wealth? You might want to consider creating a charitable foundation.

View all videos

-

Articles

-

Calculators

-

Videos